Manage Your Tax Withholdings (W-4)

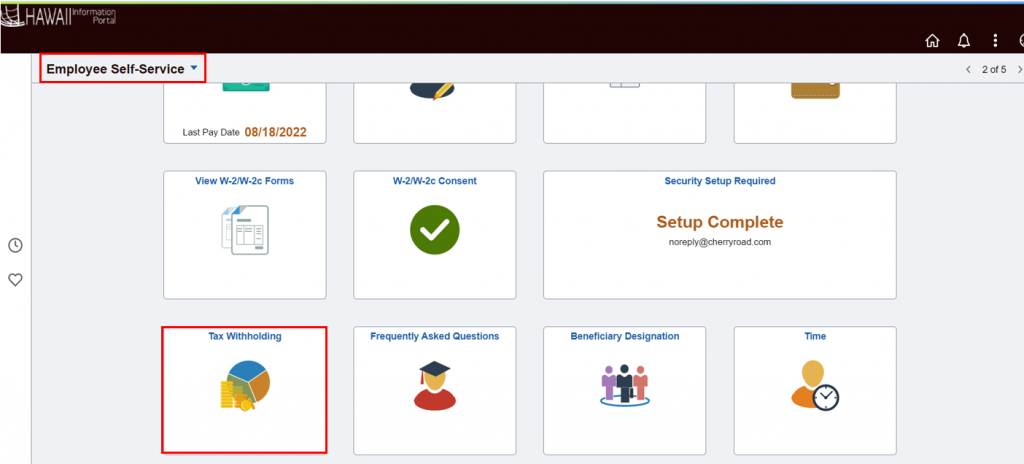

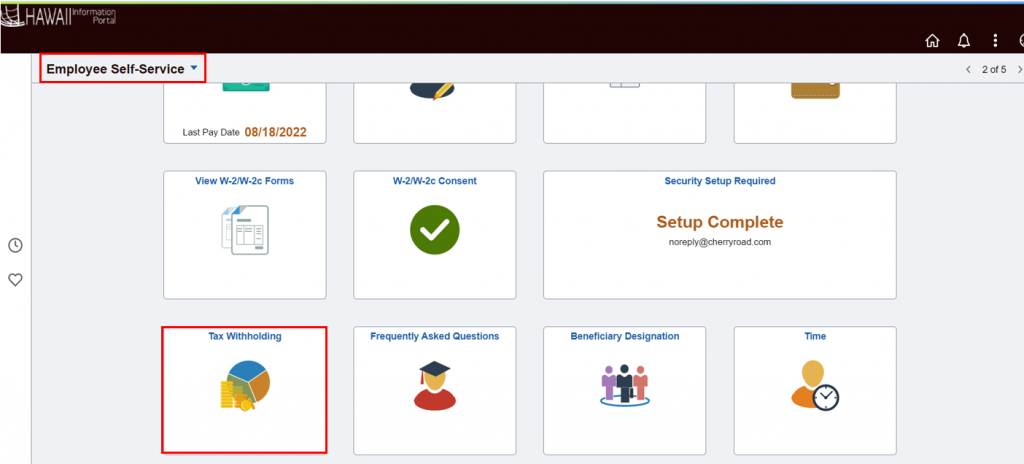

Manage your Federal and State tax withholdings from the Employee Self-Service (ESS) screen.

To make changes to your Federal and/or State tax withholdings, you must be using a computer connected to the State of Hawaii’s secure network. For help with withholdings, please consult a tax professional and/or use Federal and State resources such as the Federal FAQs. Any changes made to your tax withholdings will become effective on the next pay period processed.

It is important for new employees to make their tax withholding choices in HIP as soon as possible. Per IRS guidelines, new employees and employees who do not update their tax withholdings will automatically default to the tax marital status “Single” and “0” allowances.

NOTE: Effective 1/6/2020, the State of Hawaii has updated HIP’s W-4 form to comply with new IRS requirements for 2020. New employees hired/re-hired on or after 1/1/2020 must complete the new W-4 form. Note that the 2020 IRS W-4 form no longer offers withholding allowances (e.g. 0, 1, 2, etc.) and the form requires calculation of particular dollar values. Once a W-4 is completed, the employee’s pay statement will reflect N/A on the “Fed Withholding” line.

STEPS

1. Login to the HIP portal and navigate to your ESS screen.

2. Click on the Tax Withholding tile.

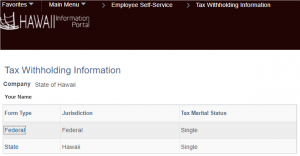

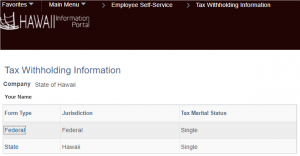

3. If you are active in one department/jurisdiction, then your existing tax withholding information will display.

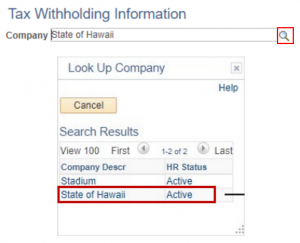

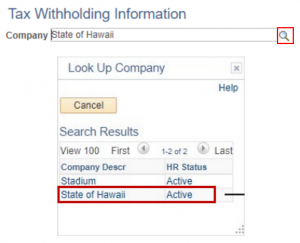

If you are active in multiple departments/jurisdictions, you will first be prompted to select the company you would like to view by clicking on the magnifying glass icon and clicking on the name of the company.

Update Your Federal Withholding

1. To update your Federal withholding information, click on the "Federal" link in the Form Type column to access your electronic W-4 form.

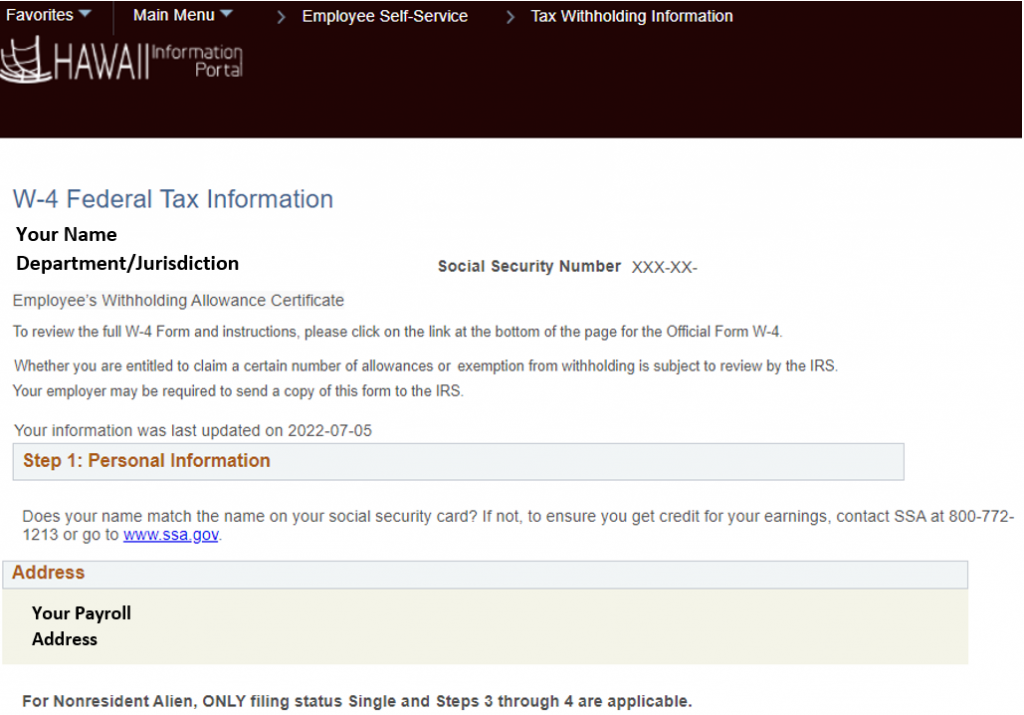

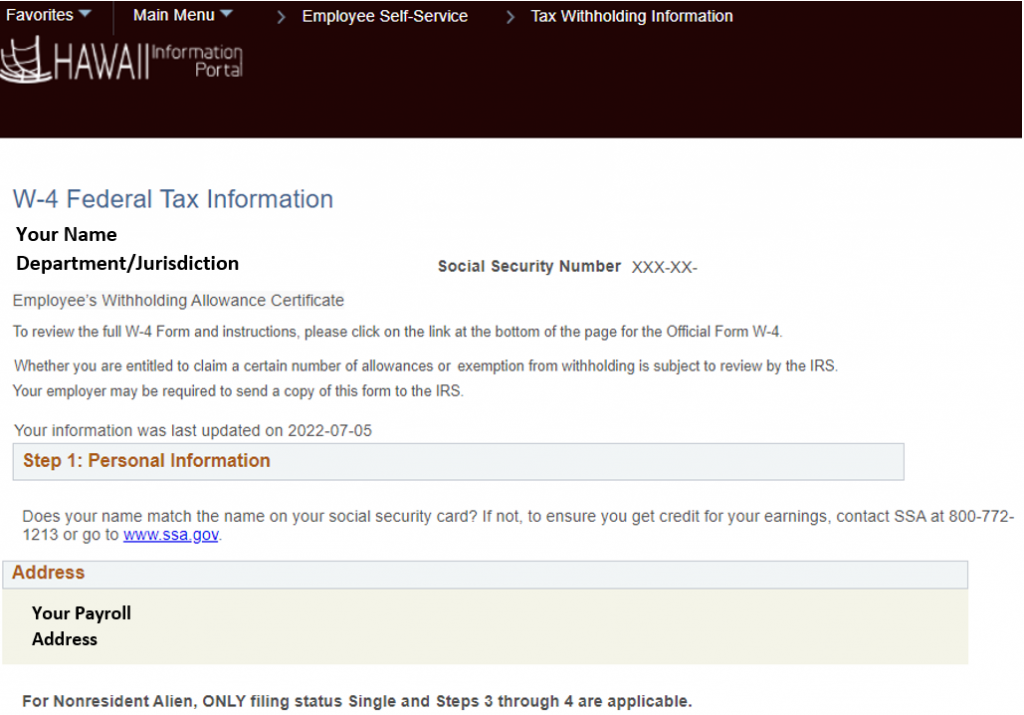

2. Your payroll related information will be displayed first for your review.

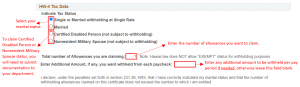

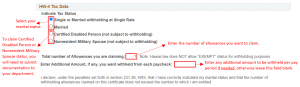

3. Enter updates to your Federal withholding.

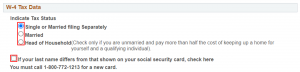

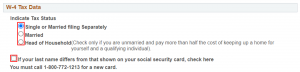

Select your Tax Marital Status and if your last name differs from your social security card.

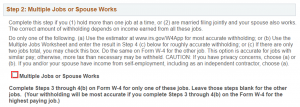

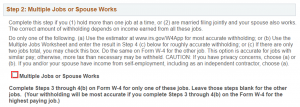

If applicable select Multiple Jobs or Spouse Works.

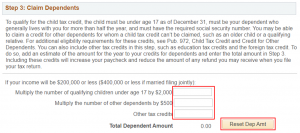

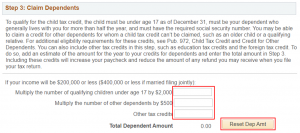

Enter the dollar amount for qualifying dependents/other tax credits. NOTE: If you need to reset your dependent amount, click on the “Reset Dep Amt” button, then the “Submit” button to bring your dependent amount to zero.

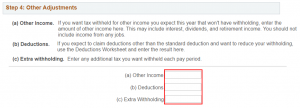

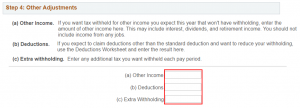

Enter any Other Income, Deductions or Extra Withholdings.

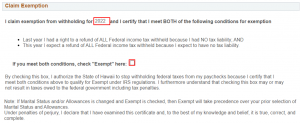

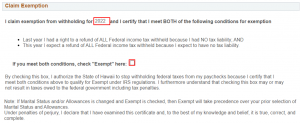

4. If you meet the exemption requirements and want to select this option, then you must enter the tax year and check the box certifying that you meet the listed conditions. This status will need to be re-elected each year by February 15th.

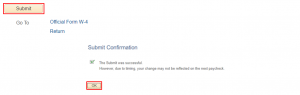

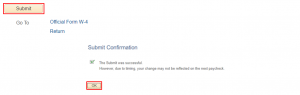

5. A link to the official Form W-4 is listed at the end of the page if you need to review the full instructions and worksheet provided. When you are finished updating your withholdings, click on the “Submit” button. You will receive a confirmation message that your updates have successfully been made. Click on the “OK” button to return to the Tax Withholding Information page.

Update Your State Withholding

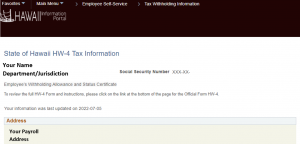

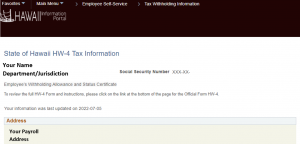

1. To update your State withholding information, click on the “State” link to access your electronic State of Hawaii HW-4 withholding form.

2. Your payroll related information will display first for your review.

3. Enter updates to your State tax withholding.

4. A link to the official Form HW-4 is listed at the bottom of the end of the page if you need to review the full instructions and worksheet provided.

5. When you are finished updating your withholdings, click on the “Submit” button. You will receive a confirmation message that your updates have successfully been made. Click on the “OK” button to return to the Tax Withholding Information page.

Related Articles

How To Get Your Pay Statements

How To Get Your Wage and Tax Statement (W-2)

Manage Your Wage and Tax Statement (W-2)

Manage Your Direct Deposit

Manage Your Payroll Beneficiaries

Setup Your Address and Emergency Contacts

Last Updated: August 31, 2022

Tags: W-4, HW-4, Federal Tax Withholding, State Tax Withholding