How To Get Your Wage and Tax Statement (W-2)

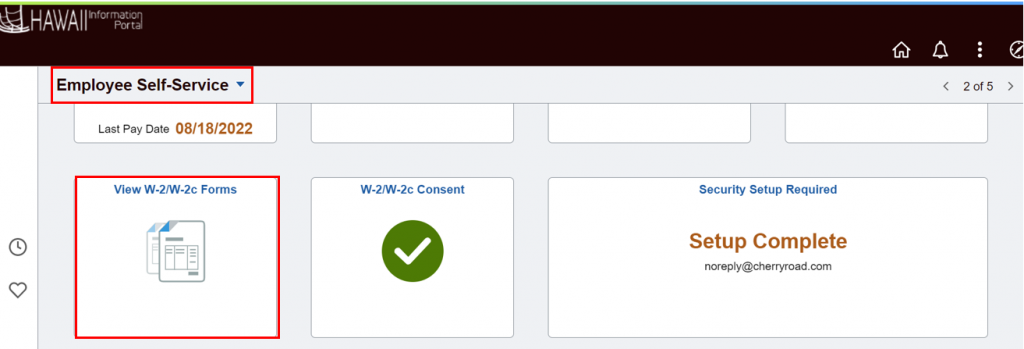

Access your W-2/W-2c from the Employee Self-Service (ESS) screen.

Every year as of 2018 going forward, your annual W-2 Wage and Tax Statement is posted in the HIP system. Employees who opt to continue receiving paper copies will get them by the last workday of January each year.

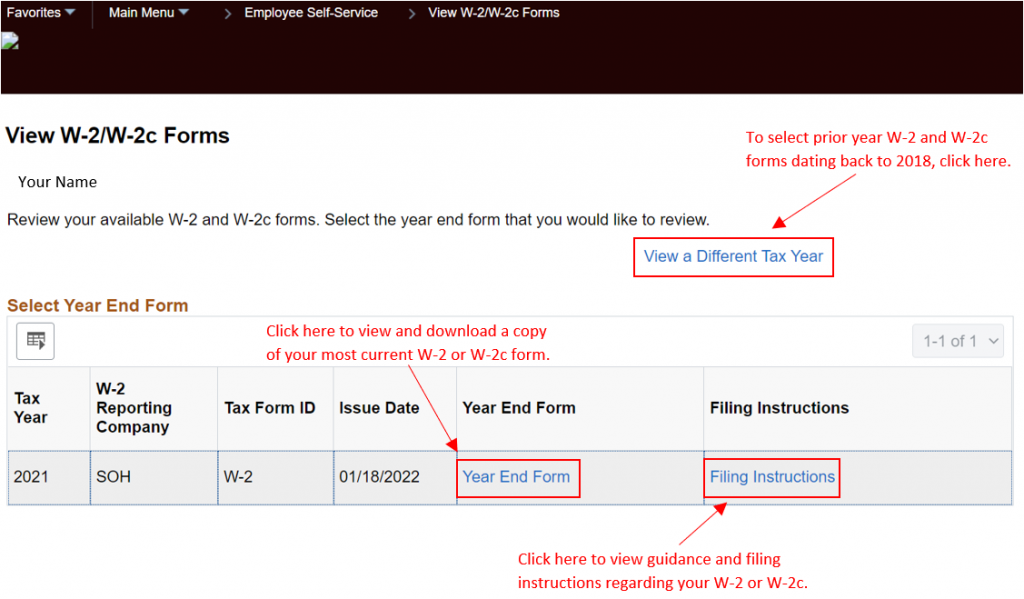

When the State of Hawaii must report corrected earnings for an employee to the IRS and/or State Department of Taxation, a W-2c (i.e., corrected W-2) is generated and also available in the HIP system.

NOTE: To access your W-2/W-2c, you must be using a computer connected to the State of Hawaii’s secure network.

STEPS

1. Login to the HIP portal and navigate to your ESS screen.

2. Click on the View W-2/W-2c Forms tile.

3. You will be taken to the View W-2/W-2c Forms screen. Your most recent W-2 or W-2c will appear in the Select Year End Form section.

View and download copies of the State of Hawaii’s W-2 Guide here and IRS Filer Instructions here.

Related Articles

Manage Your Wage and Tax Statement (W-2)

Manage Your Tax Withholdings (W-4)

Setup Your Payroll Address and Emergency Contacts

Last Updated: August 31, 2022

Tags: W-2, W-2c, Wage and Tax Statement