Get Your Pay Statement

HIP pay statements are visible on a computer as well as a mobile device using the Pay Statement tile

Guide to understanding your pay statement

![]() Your pay statements are archived for as long as you’ve been using HIP. To change the date range of pay statements you can see, use the filter icon to select the date range you’d like to view.

Your pay statements are archived for as long as you’ve been using HIP. To change the date range of pay statements you can see, use the filter icon to select the date range you’d like to view.

![]() Using the arrow icon changes the dates the pay statements are sorted in.

Using the arrow icon changes the dates the pay statements are sorted in.

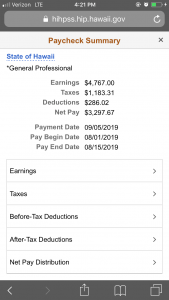

Mobile Devices

On mobile devices such as smartphones and tablets, the view is condensed to fit on a small screen.

You can expand each section — earnings, taxes, etc. – by clicking on the arrow to view more details.

If you need a full-size pay statement, you’ll want to access HIP from a computer.

Computers

On computers, HIP will generate your pay statement as a .PDF file that you can download, save, print, etc. You will need to disable your browser’s pop-up blocker to allow the .PDF pay statement to appear for you.

Your Earnings Amounts, Deductions, Taxes

The HIP Service Center does not handle employee garnishments.

As of June 20, 2024, garnishment processing will be outsourced to ADP. Partnering with ADP will better ensure we meet all the federal and state requirements with remitting payments and provide a more direct and efficient service to our employees.

Questions Regarding Your Garnishments…

- Contact DAGS Central Payroll by email at [email protected] for questions regarding payments and court orders received before the above-referenced date.

- Contact ADP for your garnishment questions after the above-referenced date since ADP will not have information regarding your garnishment payments and court orders before the date above. Contact information are as follows and you may also download the ADP app:

ADP’s Solution Center

Phone: (866) 324-5191

Monday through Friday

5:00am-5:00pm PST (Pacific Standard Time)

24/7 Interactive Voice Response System

MyADP.com and MyADP app (download the ADP Mobile Solutions app on Google® Play or the Apple® iStore)

For questions about how much you’ve earned or if you believe you are missing pay, and for general questions about your deductions or taxes, please contact your department’s payroll/fiscal office.

Didn’t Find What You Need?

W-4/HW-4 Tax Withholding Choices

Personal Details: Address, Emergency Contacts