Human Resources (HR) Frequently Asked Questions (FAQ)

The FAQ below are intended to provide helpful information in addition to HIP training and knowledge articles to aid in providing support to your employees. Click on the categories and questions to expand them, then click them again to collapse them. If you don’t see your question or answer here, please visit the HIP Ticket Center for further assistance at hipservice.hawaii.gov.

ALL DEPARTMENTS

Extended Absences (3)

The employee will be on a ‘Paid Leave of Absence’ (PLOA) status. This status will stop the employee’s wages since their salary will be driven from the Compensation tab on Job Data and not from the old Payroll Change Schedule. While this PLOA status will stop the employee’s salary, this will not stop Payroll from processing any additional supplemental payments to the employee for the purposes of TDI. Payroll will need to process any supplemental payments required to the employee as part of the payroll processing. A new reason code for TDI will be added as part of the transition to Time & Leave.

WC and TDI remain manual calculations for now, however the Time & Leave project may revisit this function in the future once all of the logic and calculation are understood.

An entry with the “Return from Leave” Action is necessary to restart the employee’s automated base pay. Automated base pay would resume once the employee is Active for a full pay period.

If no “Return from Leave” Action is entered, the automated base pay would continue to be suppressed if the reason WC/TDI with Action Paid Leave of Absence (PLA) was entered previously.

New Hires (1)

Department HR staff have the ability to run a report to obtain the new hire letter with the credentials to provide to the employee.

Navigate to Reporting Tools > BI Publisher > Query Report Viewer.

Either of the following reports can be used:

SOH_NEW_EE_D – Letter by EMPL ID

SOH_NEW_EMPL – All letters as of a certain date

It can take up to one (1) day after the new hire is entered in the HIP system so the overnight process can generate the information for the new hire letter.

Click the link for more detailed steps on how to run the reports: New Employee Onboarding ESS Process

Reports & Queries (1)

A report is available in the HIP system to view the changes an employee completes through ESS. HR users that have been assigned this access are able to view Employee Address and Emergency Contact changes. Payroll users that have been assigned this access, are able to view Tax Withholding changes.

Please refer to the link for instructions on how to generate these reports: Running ESS Reports

TIME AND LEAVE (T&L) DEPARTMENTS

Extended Absences (4)

No. While the new Time & Leave features will allow the employee to request the extended absence through HIP, it is highly recommended that you maintain good communication with the employee to ensure that all documentation needed is completed and to answer any of the employee’s questions. HIP just allows for easier review/approval of requests and tracking of the employee’s extended absence.

An over or underpayment could occur on one check and then be inadvertently adjusted on the next check if HR and Payroll don’t coordinate on which payroll cycle will be used for the reclass. This is because both Payroll entries and HR entries are pieces of the reclass.

Consider the following scenario for the July 20, 2022 paycheck where the Supervisor deadline was July 11, 2022 and Central Payroll begins processing the morning after the Supervisor deadline. If Department Payroll enters RNG for -$242.35 by July 8, 2022, but HR admin enters and approves the WC Sick hours and amount of $242.35 on July 13, 2022 (during Lock Out period), those amounts would not process for the same paycheck date as any new T&L entries submitted after the Supervisor Deadline will be held for the next payroll processing cycle. In this situation, for July 20, 2022, Payroll’s negative entry would be recognized to reduce pay by -$242.35 but the positive $242.35 from the HR Admin WC Sick entry would be on hold until the next paycheck cycle and added to the employee’s August 5, 2022 check instead. If both HR and Payroll had entered their entries by July 8, 2022 (prior to the Supervisor Deadline), then there would have been a next zero impact on the employee’s July 20th check (-$242.35 + $242.35 = 0).

Further guidance on reclassification can be found via the guides:

https://ags.hawaii.gov/hip/files/2022/10/Workers-Comp-Process-Guide.pdf

https://ags.hawaii.gov/hip/files/2022/07/TDI-Workflow-Guide.pdf

Yes, HIP will allow the employee to upload documents as part of the process of requesting the extended absence. This will allow you to review the request as well as the documentation to ensure full compliance prior to approving the request in HIP.

Yes, HR Admins are able to request extended absences for employees in HIP if the employee is not able to or does not have access to a computer. While the employee is highly encouraged to submit their own request through HIP, the HR Admin is able to initiate the request if necessary.

HR Processing Questions (2)

HRMS (8)

No, this will not affect processing an employee’s paycheck. The only thing that will be affected is when a new position is created. The new position will require the new department to be inputted.

No, there will be no change in historical records. This rate code will not have an impact on payroll.

No, HR will not be required to update this field and no update will be processed with the transition to Time & Leave.

Yes, once employees transition to T&L, salaried employees will be converted from “E” to “S” (Salaried). There will be a small group of employees that will continue to be classified as “E”, in which they will need to report their time to be paid. These employees will typically be paid through grants and the department will need to track their hours worked. The HIP Project Team will work with each department to identify these types of individuals prior to the transition.

There are no employees in the Department of Accounting & General Services, Office of the Governor, and the Office of the Lt. Governor that will be classified as “E”.

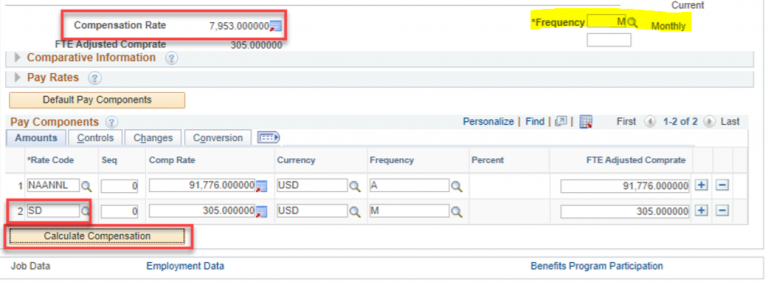

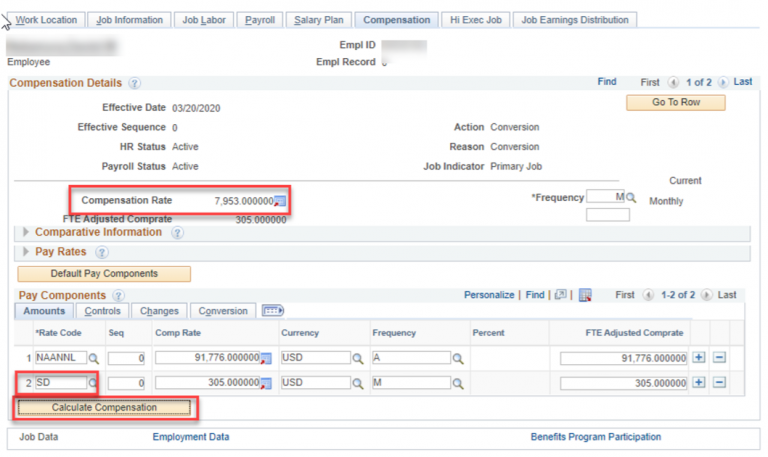

The “Calculate Compensation” button only needs to be clicked if you are adding or removing differentials from the employee’s compensation. All differentials need to be included in the compensation rate to determine the hourly rate. Click the following link to view a list of Compensation Rate Codes.

You will want to enter the number of hours that the employee is expected to work per week. For example, if an Airport Firefighter is required to work 56 hours per week, you will enter ’56’ as the Standard Hours, and HRMS will update the FTE percentage accordingly, which would be 1.40.

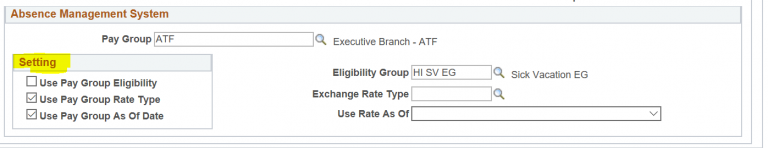

No, it will not be grayed out. However, if a user changes the information, a pop-up message will state that an Absence Management Pay Group is required and not change the information.

Leave Balance Adjustments (3)

The most common time when a leave balance adjustment would be processed would be when an employee leaves State service. As part of the vacation payout process, the HR Admin will zero out the vacation balance prior to paying out the vacation. Other times that a leave balance adjustment would be necessary is for any retroactive submission of leave requests processed by the Leave Keeper prior to GoLive, and for employee transfers between departments participating in Time & Leave and not participating in Time & Leave.

If an employee submits a late leave request for dates prior to GoLive, your Leave Keeper will process the leave manually and will notify you to adjust the employee’s leave balance. The adjustment is necessary as all leave balances should be accurate as of GoLive.

If both departments involved in an employee transfer are participating in Time & Leave, the balance is automatically transferred without the HR Admin having to do a balance adjustment, but there will still be a fiscal process involved in writing/receiving a check for the value of their accrued leave.

However, if the employee transfers to a department that does not participate in Time & Leave, a manual adjustment will need to be processed on HIP to zero out the former employee’s leave balances. The receiving department will need to be notified of the employee’s leave balances to be processed into their system.

If the employee is transferring from a department that is not participating in Time & Leave to a department that is participating in Time and Leave, the departing HR office should notify you of the employee’s leave balances as of the transfer date so that you can process a leave balance adjustment to add hours on HIP to the employee’s leave balances.

New Hires (1)

Payroll Questions (3)

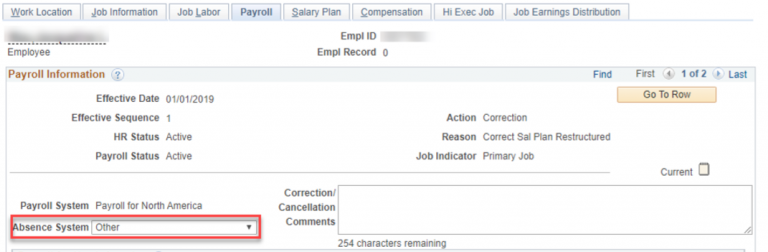

As the T&L project is a phased development with groups of departments, some departments will be up on T&L while others are not. The new Pay Groups are meant to account for those that are processing the old way versus the new way.

For other pay (TDI and WC), your department payroll staff is going to be directly involved in entering the information. Most other types of pay will be directly entered by employees and approved by supervisors, and it will not need intervention by your department payroll staff. Your payroll staff will need to work on exceptions and resolve those by deadlines. It’s important to note that your payroll staff can check daily throughout the entire pay period and they need not wait until the end of the pay period to get started on their reviews. The State’s deadline for payroll submission will be the same as it is today. There will be a Comptroller’s Memorandum that comes out requiring employees to submit their documents for each pay period by pay period closing.

No, since the funding source is not the same as the one charging to base pay, Payroll will not generate an ePAR for this type of transaction.

Reports & Queries (1)

Please review the document HR ePCS Interface Queries for guidance on how to view interface files in the HIP system.

Timesheet Questions (2)

The HIP system has certain logic to ensure that employee input is valid. For instance, it will require that the employee enter comments when entering certain types of time, to help the supervisor review the entry to make sure it is valid. In addition, an employee will not have access to take leave that they are not entitled to by union agreement, policy, etc.

In the HIP system, Comp Time is tracked as a type of time as opposed to a type of leave. When an employee works overtime and reports their hours on their timesheet, they’ll have the choice to use a code for overtime to generate an overtime payment, or a code for Comp Time to be used later. If they use Comp Time, their Comp Time balance will be visible in HIP on a designated tile. When they want to subsequently use their Comp Time, the employee will again report their Comp Time taken on a later timesheet.