How do I enter the Federal tax withholding for an employee that submitted a hard copy W-4 form?

If the employee is unable to enter his/her tax withholding on ESS, you may enter the withholding options on his/her behalf if you receive a signed copy of their Federal W-4 form. Effective 01/01/2020, the format of the form has changed.

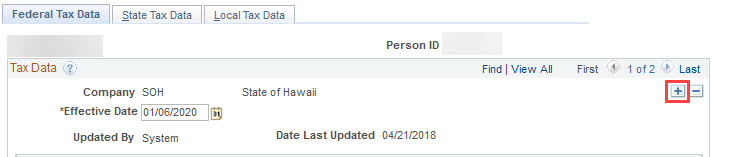

Navigate to Payroll for North America > Employee Pay Data USA > Tax Information > Update Employee Tax Data

1. Add a new row.

2. Follow the steps in the link below for instructions on how to input based on the new format.

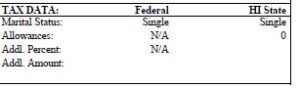

NOTE: If the new W-4 is used, since the format has changed, the employee’s pay statements reflect N/A for values that are no longer included in the new W-4 format (i.e. N/A for Allowances).