How do I update the status for employees that are claiming married but withhold at the single rate on the State HW-4?

1. Navigate to Update Employee Tax Data and add a new row.

Payroll for North America > Employee Pay Data USA > Tax Information > Update Employee Tax Data

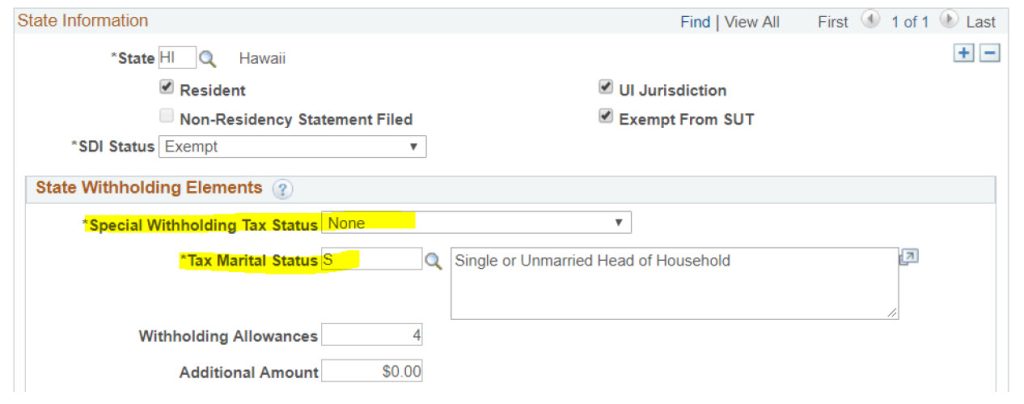

2. Go to the State tab and change the Tax Marital Status to “S” for Single.

This allows the system to use the single rate table that has been setup to calculate taxes.

NOTE: As of 01/01/2020, this is no longer an option for Federal Tax Data.