How do I elect no State or Federal taxes for my tax withholdings?

The following represents general instructions, but it is recommended to discuss with a qualified tax representative on what may be best for your tax situation if you have any questions on what you should select.

For Federal withholding taxes, when you claim “exempt” on your Federal Withholding (W-4), you will not make any tax payments. Please ensure you meet the conditions for exemption before checking the box.

Click here to find more useful information about Form W-4.

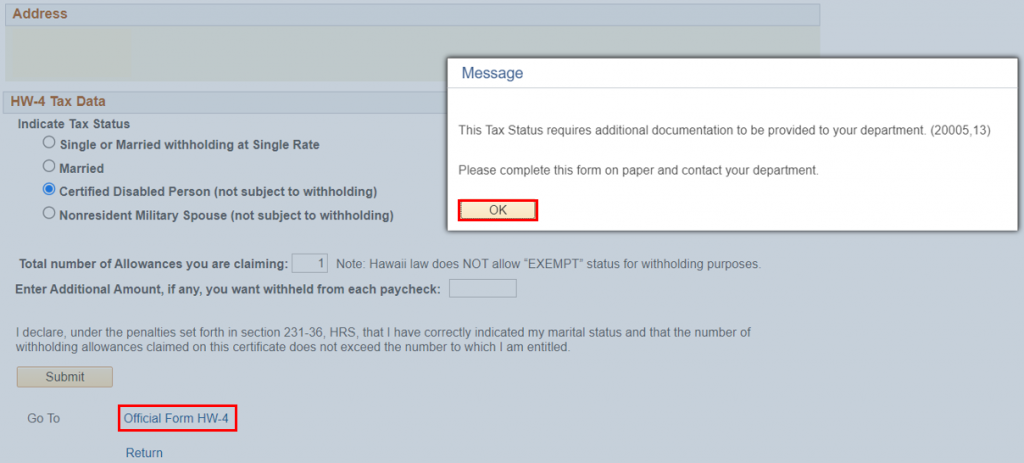

For Hawaii State withholding tax, if you are claiming a Nonresident Military Spouse or Certified Disabled Person status, you are indicating that you not subject to State tax withholdings. However, you will need to fill out a Form HW-4 and return it to your department payroll office with the necessary backup documentation verifying your status for your department representative to transact on your behalf.

For more information click here to view and download the State of Hawaii Department of Taxation Booklet A, Employer’s Tax Guide (see section What is Not Subject to Withholding).