How do I add additional retirement deductions?

There are two (2) types of ERS repayment deductions that require a different setup under the employee’s General Deductions. Category 1 covers ERS coding errors and Category 2 covers employee arrangements with ERS.

Go to the “General Deductions” icon to add a new additional retirement deduction, or use the following navigation:

Payroll for North America > Employee Pay Data USA > Deductions > Create General Deductions

Category 1: If there is a coding error (i.e. employee was designated as HO/11 upon hire, but should instead be H1/11) and an employee owes an additional amount, you will need to setup the payment according to the payment plan determined with your employee. See https://hipservice.hawaii.gov/s/article/ERS-minimum-repayment-requirement for minimum requirement guidelines.

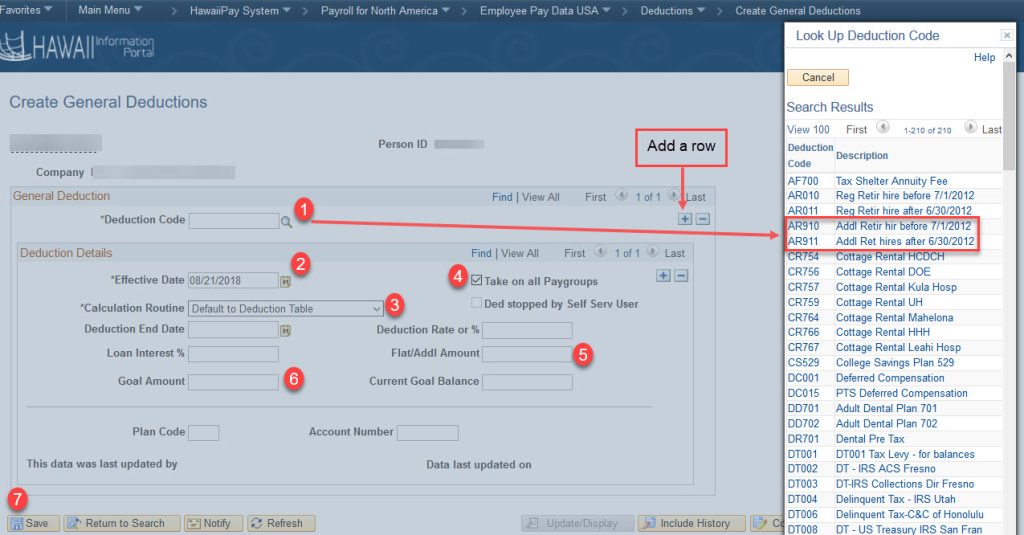

Add a row at the top and then do the following:

1. Enter the appropriate deduction code.

- Use AR910 for employees hired before 7/1/2012.

- Use AR911 for employees hired after 6/30/2012.

2. Enter the beginning of the pay period of when the deduction should be effective. For example: To start the deduction from the 4/5/19 paycheck:

- ATF employees, use effective date 3/1/19.

- LAG employees, use effective date 3/16/19.

3. Update the calculation routine.

- Use “Flat Amount” if a flat amount should be deducted.

4. Leave the box checked next to “Take on all Paygroups”.

5. Enter the amount that should be deducted each pay period.

6. Enter the total amount to be deducted (once the balance reaches this amount, the deduction will stop.)

7. Click the Save button.

Category 2: The employee has made arrangements with ERS to purchase additional service credits. ERS would reach out to you directly with the amount to establish on the employee’s general deduction record.

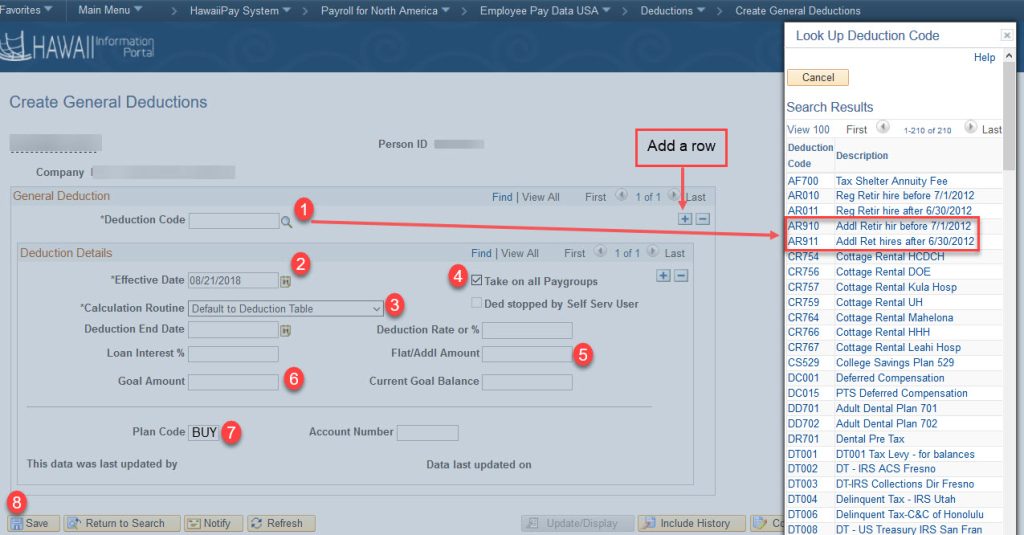

Add a row at the top and then do the following:

1. Enter the appropriate deduction code.

- Use AR910 for employees hired before 7/1/2012

- Use AR911 for employees hired after 6/30/2012

2. Enter the beginning of the pay period when the deduction should be effective. For example: To start the deduction from the 4/5/19 paycheck:

- ATF employees, use effective date 3/1/19

- LAG employees, use effective date 3/16/19

3. Update the calculation routine.

- Use “Flat Amount” if a flat amount should be deducted.

4. Leave the box checked next to “Take on all Paygroups”.

5. Enter the amount that should be deducted each pay period.

6. Enter the total amount to be deducted (once the balance reaches this amount, the deduction will stop.)

7. Enter BUY in the plan code field.

8. Click the Save button.

NOTE: Entries need to be entered by the PCS deadline day to take effect.