General Time and Leave FAQs

Human Resources Management System (HRMS) Questions

With the new department ID implementation, will this impact an employee’s paycheck if a department forgets to update the department ID?

No, this will not affect processing an employee’s paycheck. The only thing that will be affected is when a new position is created. The new position will require the new department to be inputted.

Will HRMS allow me to save the record if both the Supervisor ID and Reports To fields have data in them?

Please use the Reports To field. The Supervisor ID field must be blank.

If the Standard Hours for Full Time Equivalency (FTE) is 40 hours per week, how is the Standard Hours used to calculate FTE entered if an employee normally works over 40 hours per week (e.g. Airport Firefighters)?

You will want to enter the number of hours that the employee is expected to work per week. For example, if an Airport Firefighter is required to work 56 hours per week, you will enter ‘56’ as the Standard Hours, and HRMS will update the FTE percentage accordingly, which would be 1.40.

When employees are converted to Time and Leave, will the Employee Type “E” (Exception Hourly) status no longer be used?

Yes, once employees transition to Time and Leave, salaried employees will be converted from “E” to “S” (Salaried). There will be a small group of employees that will continue to be classified as “E”, in which they will need to report their time to be paid. These employees will typically be paid through grants and the department will need to track their hours worked. The HIP Project Team will work with each department to identify these types of individuals prior to the transition.

There are no employees in the Department of Accounting & General Services, Office of the Governor, and the Office of the Lt. Governor that will be classified as “E”.

If an employee is not on Time and Leave, will the “Absence System” be grayed out so the user cannot touch the information?

No, it will not be grayed out. However, if a user changes the information, a pop-up message will state that an Absence Management Pay Group is required and not change the information.

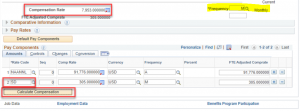

Will there be an update to historical records for employees with the transition to Time and Leave for the Compensation code (e.g. NAHRLY or NAANNL)?

There will be no change in historical records. This rate code will not have an impact on payroll.

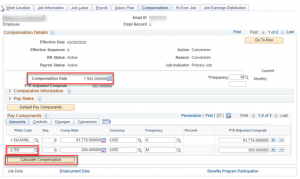

When does the ‘Calculate Compensation’ button need to be pressed?

The ‘Calculate Compensation’ button only needs to be clicked if you are adding or removing differentials from the employee’s compensation. All differentials need to be included in the compensation rate to determine the hourly rate. You can find a list of compensation rate codes here.

Will records currently showing Frequency as ‘S’ (Semimonthly) be updated with ‘M’ (Monthly)? Does HR need to update this?

No, HR will not be required to update this field and no update will be processed with the transition to Time and Leave.

Human Resources Process Questions

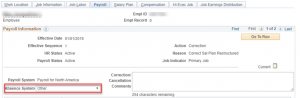

When inputting a new hire, does HR have to touch the settings on HRMS in the Payroll tab?

No action is needed when establishing a new employee record.

No action is needed when establishing a new employee record.

Who will be responsible for inserting the Uniform Accounting Code (UAC) for Regular pay?

HR will be responsible for entering the UAC for regular pay.

Who will be responsible for maintaining the Uniform Accounting Code (UAC) for non-base earnings?

Payroll will be responsible for maintaining the UACs for non-base earnings.

Timesheet Questions

Will the system check the employee’s input in Employee Self-Service to validate that it’s correct?

HIP has certain logic to ensure that employee input is valid. For instance, it will require that the employee enter comments when entering certain types of time, to help the supervisor review the entry to make sure it is valid. As well, an employee will not have access to take leave that they are not entitled to by union agreement, policy, etc.

How is Compensatory Time tracked?

In HIP, Compensatory Time is tracked as a type of time as opposed to a type of leave. When an employee works overtime and reports their hours on their time sheet, they’ll have the choice to use a code for overtime to generate an overtime payment, or a code for comp time to be used later. If they use comp time, their comp time balance will be visible in HIP on a special tile. When they want to subsequently use their comp time, the employee will again report their comp time taken on a later time sheet.

Payroll Questions

Why are different pay groups being created for Time and Leave?

As the Time and Leave project is a phased deployment with groups of departments, some departments will be up on HIP T&L while others are not. The new pay groups are meant to account for those that are processing the old way versus the new way.

We would like to recommend giving our department a verification period of three (3) days to verify the payroll information prior to final submission. Checking time sheets and overtime, other pay (TDI, workers’ comp, etc.), & payroll changes. How would that work?

For other pay (TDI & workers’ comp), your department payroll staff is going to be directly involved in entering the information. Most other types of pay will be directly entered by employees and approved by supervisors, and it will not need intervention by your department payroll staff. Your payroll staff will need to work on exceptions and resolve those by deadlines. It’s important to note that your payroll staff can check daily throughout the entire pay period and they need not wait until the end of the pay period to get started on their reviews. The State’s deadline for payroll submission will be the same as it is today. There will be a Comptroller’s Memorandum that comes out requiring employees to submit their documents for each pay period by pay period closing.

Does an electronic Personnel Action Report (ePAR) need to be generated for Uniform Accounting Code (UAC) updates to non-base pay?

No, since the funding source is not the same as the one charging to base pay, Payroll will not generate an ePAR for this type of transaction.

Didn’t Find What You Need?

Time and Leave Topic: HR Administrator Overview

Time and Leave Topic: Extended Absence